Developing Carbon Projects with Real Impact

From reforestation to soil carbon enhancement and biochar deployment, with measurable carbon outcomes and verified credit issuance.

Learn MoreDNZ’s Role in

Climate Impact Projects

DNZ plays a critical role in transforming climate impact solutions into high-integrity, verified carbon assets. We support both technology-based and nature-based approaches—ranging from forest restoration and soil carbon enhancement to biochar deployment. Our team guides projects from concept to credit, managing every stage including feasibility assessments, technical design, MRV (Monitoring, Reporting, and Verification), and carbon credit issuance. By leveraging a robust ecosystem of trusted partners, DNZ helps scale climate impact while ensuring traceability, transparency, and lasting value for both investors and local communities.

Scalable Impact Across Sectors

Our solutions span real estate, industry, and natural ecosystems—making carbon reduction scalable, measurable, and aligned with your ESG goals.

End-to-End Project Enablement

We partner with landowners, businesses, and local communities to co-create decarbonisation initiatives—providing technical, strategic, and compliance support from inception to implementation.

Climate Impact Projects – Overview

As the world accelerates toward net-zero, restoring forests, soils, and degraded ecosystems offers one of the most scalable and impactful ways to remove carbon from the atmosphere — while generating co-benefits like biodiversity, water security, and community uplift. Demand for high-quality, verified credits from such projects continues to grow across both voluntary and compliance markets.

Discover our projects

Our Work

on the Ground

We restore degraded forests and improve soil health through long-term reforestation and land management. Our projects support climate goals and create benefits for local communities.

Project Mongolia

Restoring forests and soils to remove carbon and rebuild dryland resilience.

In Mongolia, large areas of forest have been lost due to fire, logging, and land degradation. We are working to bring life back to these lands by planting native trees and improving soil health with bio-based methods.

We started with 5,000 hectares in Tuv and Arkhangai provinces. Over time, the project will expand to cover up to 100,000 hectares. Two nurseries have been set up to grow millions of trees annually. These forests will help remove carbon from the air, improve the land’s long-term health, and support local communities.

This project is developed by a consortium of KinCarbon, DNZ ClimateTech, and Clean BotanEco, in collaboration with government agencies and local partners.

- 5,000 hectares now. 100,000 ahead.

Once barren, these lands in Tuv and Arkhangai provinces will be restored with native tree species — creating climate-resilient ecosystems and carbon sinks for generations.

- +10% Soil Organic Matter in 40 years

Through soil bio-stimulants and regenerative forestry, the land will store significantly more carbon underground, enhancing both soil fertility and climate mitigation impact.

- 6M native trees yearly by 2026

From two dedicated nurseries across 8 hectares, we cultivate species like Larch, Elm, Birch, Pine, Willow and Poplar — designed to thrive in Mongolia’s highlands.

- 1 mission, 3 partners, 1 planet

KinCarbon, DNZ ClimateTech and Clean BotanEco unite expertise in nature-based carbon removal, local agriculture, and sustainable financing — to help Mongolia become a regional leader in climate action.

Restoring Forests. Rebuilding Soils.

Mongolia’s average temperature has risen more than twice the global rate, leading to longer droughts, harsher winters, and increased forest loss across its dry northern regions.

- 5,000 hectares now. 100,000 ahead.

Project Papua New Guinea

DNZ is supporting a high-quality REDD+ project in one of Papua New Guinea’s most remote provinces.

The project aims to protect rainforest, reduce emissions, and improve local livelihoods. Developed with an experienced partner, it follows Article 6 of the Paris Agreement and meets international carbon standards.

- What This Project Delivers

Reduce Greenhouse Gas Emissions

Avoid deforestation and forest degradationBiodiversity Conservation

Preserve key habitats and protect endangered species

Community Livelihood Improvement

Income generation opportunities and Sustainable resource access

Climate Change Adaptation

Reduce vulnerability to climate impacts and Implement forest management and fire prevention

Sustainable Land Use Practices

Promote agroforestry and sustainable agriculture

Protecting rainforests to avoid emissions

Rising temperatures and shifting rainfall in Papua New Guinea are putting pressure on its rainforests, increasing the risk of fires, flooding, and biodiversity loss in one of the world’s most fragile ecosystems.

- What This Project Delivers

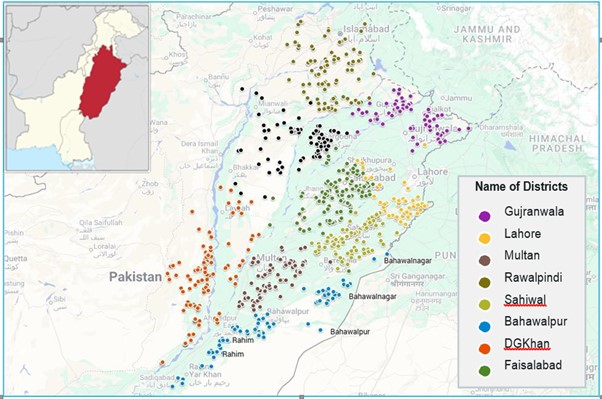

Project Pakistan

Empowering Communities and Delivering Certified Climate Impact

The Pakistan Clean Water Project is developed by ATR to provide clean and safe drinking water to rural communities across Pakistan. By installing innovative water filtration and treatment systems, the project eliminates the need for boiling water using firewood or fossil fuels, thereby significantly reducing greenhouse gas emissions.

The project is being certified under CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), ensuring that its emission reductions meet stringent international standards. The resulting carbon credits will support the aviation sector’s decarbonisation while improving community health and resilience.

- Key Impacts

- Provision of clean and safe drinking water to underserved communities

- Reduction in fuel consumption and greenhouse gas emissions

Certification under CORSIA for high-quality, aviation-grade carbon credits - Establishment of Pakistan’s national carbon registry for corresponding adjustments

- Improvement in health and well-being by reducing indoor air pollution

- Advancement of multiple UN Sustainable Development Goals

DNZ supports ATR in this impactful initiative by leveraging its networks and expertise to bring the certified CORSIA credits to global buyers, connecting this high-integrity project to corporations seeking to achieve their climate commitments.

ATR and DNZ have also signed a strategic partnership agreement to scale and undertake carbon projects across Southeast Asia, co-sharing expertise and resources to maximise impact and accelerate climate solutions in the region.

Together, ATR and DNZ are enabling solutions that protect people, improve lives, and accelerate the world’s transition to a low-carbon future.

Clean Water. Saving Lives.

Unsafe water and poor sanitation kill over 50,000 children under five in Pakistan every year. Our clean water project isn’t just cutting carbon—it’s saving lives, protecting families, and building healthier communities.

- Key Impacts

We’ll show you how your facilities can cut carbon

What types of climate impact projects does DNZ support?

DNZ supports a diverse portfolio of high-impact carbon projects, including:

- Nature-based solutions (e.g., reforestation, afforestation, mangrove restoration, soil carbon)

- Energy efficiency (e.g., industrial retrofits, building upgrades)

- Renewable energy (e.g., solar, wind, biogas)

- Industrial decarbonisation (e.g., carbon capture, pyrolysis)

Who can initiate a carbon project with DNZ?

Any entity with a credible emissions reduction or removal initiative can partner with DNZ, including:

- Project developers

- Corporates and utilities

- NGOs and community organisations

- Governments and municipalities

DNZ evaluates each project for impact potential, feasibility, and alignment with recognised standards.

What standards do you follow for carbon credit verification?

DNZ works with globally recognised verification standards, including:

- Verra (VCS)

- Gold Standard

- PuroEarth

- Asia Carbon Institute

These frameworks ensure rigorous MRV (Monitoring, Reporting & Verification) and credibility in the carbon market.

How long does it take to develop a carbon project?

The timeline varies depending on project type and scale, but generally:

- Pre-feasibility to registration: 6–12 months

- Credit issuance (post verification): Typically within 12–24 months after implementation.

Some fast-track projects (e.g., renewable energy) may see issuance sooner.

Can DNZ help sell the carbon credits?

Yes. DNZ provides end-to-end commercial support, including:

- Access to buyers and marketplaces

- Marketing and ESG positioning of credits

- Retirement services with full audit trails

What are the financial benefits of developing a carbon project?

Carbon projects can generate revenue through the sale of verified carbon credits, creating:

- New income streams for project owners and communities

- Attractive returns for investors and partners

- Blended finance opportunities through grants, carbon finance, and private capital

- Long-term value by aligning with ESG goals and green investment mandates